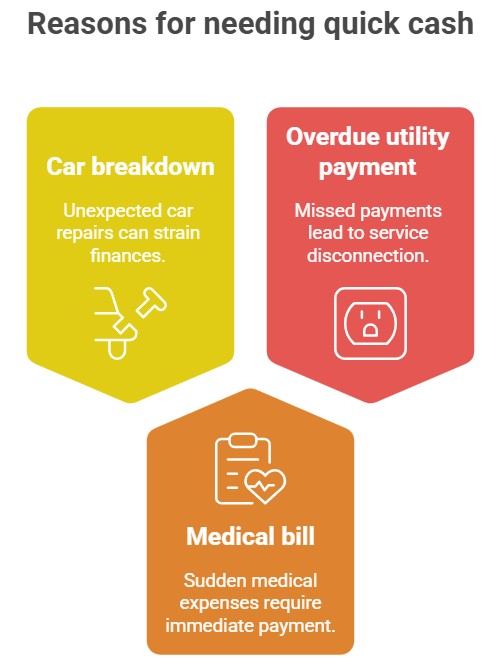

When you're dealing with a financial emergency, time is everything. Whether it’s a sudden car breakdown, a medical bill, or an overdue utility payment, you need quick access to cash. That's where no denial payday loans direct lenders only no credit check come into play designed to provide emergency cash immediately, without the usual hassle of traditional bank loans.

But the real question is: how fast can you actually receive the money?

Read more

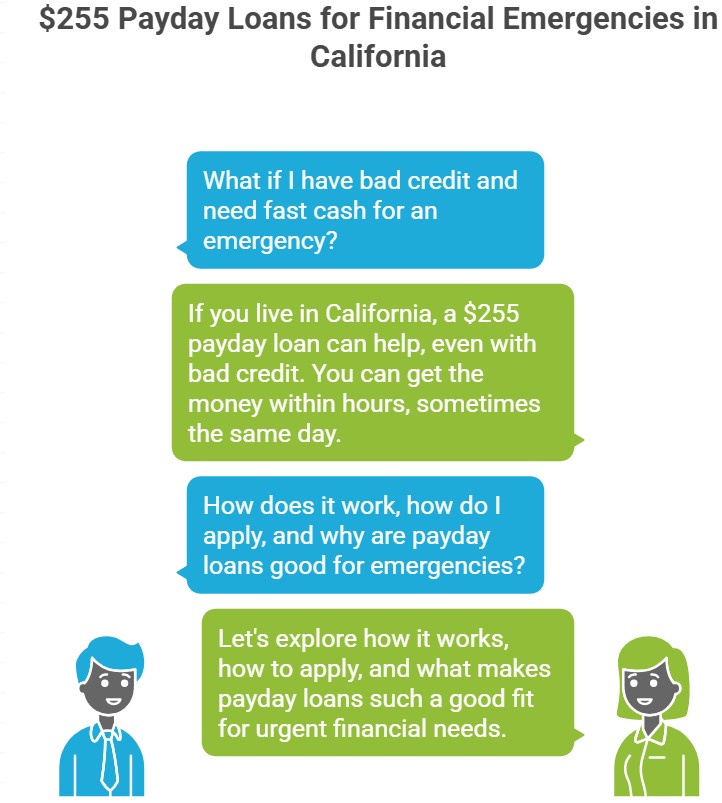

Financial emergencies don’t come with a warning. Whether it’s an unexpected car repair, an urgent medical bill, or a utility notice you weren’t expecting, situations like these demand fast access to cash. But if you have bad credit, getting approved for a loan might seem like an uphill battle.

Thankfully, if you live in California, there’s a practical solution the $255 payday loan, a short-term borrowing option designed specifically for emergencies. Even better, you can qualify even with bad credit and get the money within hours, sometimes the same day.

Let’s explore how this works, how to apply, and what makes payday loans such a good fit for urgent financial needs.

Read more

Online shopping offers convenience, variety, and accessibility, allowing us to purchase nearly anything from the comfort of our homes. But with this convenience comes the need to protect yourself from potential scams and security threats. From safeguarding your personal information to using secure payment methods, knowing how to shop safely online is crucial.

Read more

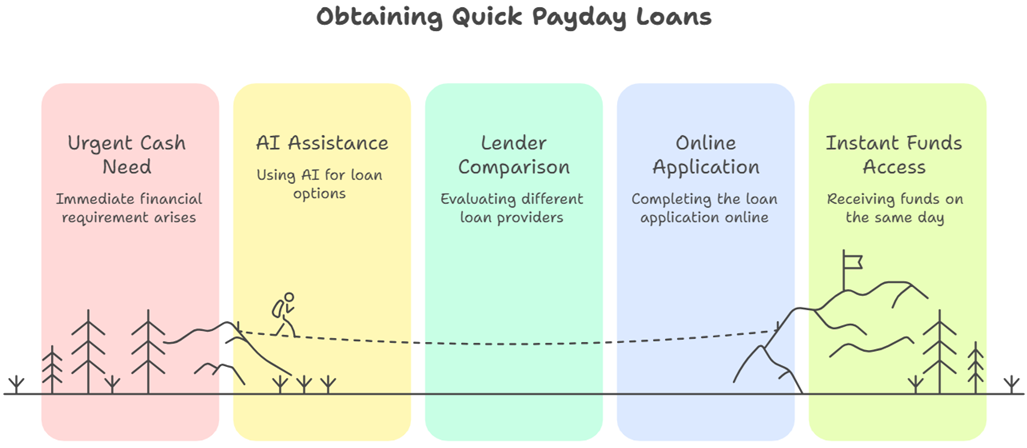

Financial needs can arise unexpectedly in today's world, and waiting days for loan approval isn't always an option. Whether it’s a medical emergency, an unexpected car repair, or a last minute bill, having access to quick cash can make all the difference.

Read more

As the holiday season approaches, malls and stores everywhere begin to overflow with shoppers. The hustle and bustle can be exciting, but it often comes with crowded aisles, long lines, and high stress levels. With online shopping, you can avoid the rush, compare deals, and shop from the comfort of your home—all without sacrificing quality or savings.

Read more

When unexpected expenses arise, finding a fast, reliable source of cash can be challenging, especially if you have bad credit. For many, payday loans provide a straightforward solution, allowing you to cover urgent needs and pay back the amount when your next paycheck arrives.

Read more

In today's fast paced world, financial emergencies can happen without warning. Whether it's a sudden doctor bill, unexpected car repair, or pressing utility payment, having access to fast cash is crucial when you're in a tight spot. This is where online payday loans come into play.

Read more

As the holiday season approaches, with Black Friday, Christmas, and New Year just around the corner, many people find themselves facing unexpected expenses. From holiday shopping sprees to last-minute travel and gift-giving, financial stress can build up quickly. For those seeking quick relief, $255 payday loans online same day are often the easiest cash loans to get approved for. These loans can bridge the gap when funds run low, ensuring you make the most of the holiday spirit without financial worries.

Read more

In today’s world, financial emergencies can arise without warning, and sometimes, you need quick access to funds to cover urgent expenses. Whether it’s a doctor bill, car repair, or a pending utility payment, having fast cash on hand can be essential. $500 cash advance payday loans provide a convenient solution to help manage these unexpected expenses, without the need for a hard credit check.

Read more